Key Takeaways:

- Integrating GRC into NCA and SAMA cybersecurity controls helps Saudi enterprises align smoothly and fast, making them stay compliant in the long run.

- Unified governance with GRC integration effectively reduces compliance overlap, eliminating duplication or redundant control assessments.

- Businesses derive improved visibility into financial, cyber, and operational risks, thanks to the centralized risk framework through GRC integration.

- Automation with GRC tools helps with faster audits and reporting, and improves regulatory readiness.

- A holistic approach to GRC adoption helps Saudi businesses strengthen their resilience in the long run.

- Incorporating GRC into the SAMA and NCA compliance processes offers a unified strategy to managing risks, meeting regulatory standards, and ensuring operational alignment with strategic goals.

Table of Contents

Toggle- Why Do Enterprises Need GRC-Integrated SAMA and NCA Alignment in Saudi Arabia?

- Understanding the SAMA Cybersecurity Framework (CSF) in Saudi Arabia

- Understanding NCA Essential Cybersecurity Controls (ECC)

- Why Saudi Businesses Should integrate GRC across SAMA & NCA rather than treat them separately

- Key components of a holistic GRC framework for Saudi enterprises

- Role of technical controls and validation (including penetration testing) in GRC, Saudi Arabia

- Implementing GRC Into NCA and SAMA Compliance Process for Saudi Enterprises

- How a Saudi-Based Financial Institution Successfully Met NCA and SAMA Compliance By Effectively Implementing GRC

- How can Saudi BFSI & SaaS Providers Benefit From Integrating GRC Across NCA and SAMA?

- Grc Saudi Arabia FAQs

Why Do Enterprises Need GRC-Integrated SAMA and NCA Alignment in Saudi Arabia?

Needing to juggle with both SAMA and NCA can be painstakingly complex, further complicated by factors like siloed risk management and escalating audit pressure. This is compounded by the fact that the compliance burden will grow at an exponential rate.

Then follows the harsh penalties like financial loss and reputational damage brought on by.

compliance-specific issues like misinterpretations and improper implementation.

The inconsistent evidence and audit fatigue when complying separately with NCA and SAMA, their non-negotiable nature significantly underpin the need to adopt a holistic approach. A unified GRC strategy has been recognized as highly effective in this regard.

Following the integration of GRC, Saudi Arabia, this has eased the compliance process across NCA ECC (National Cybersecurity Authority Essential Cybersecurity Controls) and SAMA Cybersecurity Framework (CSF).

But what is a unified GRC strategy, and how can it help businesses like you stay compliant and secure within a single framework? You’ll learn about this in detail as this blog unfolds.

Understanding the SAMA Cybersecurity Framework (CSF) in Saudi Arabia

The Saudi Central Bank (Saudi Arabian Monetary Authority)-issued SAMA Cybersecurity Framework (SAMA CSF) includes a set of guidelines, regulations, and policies to regulate and strengthen the cybersecurity capabilities of the financial institutions of the financial sector in the Kingdom.

True to the above statements, the SAMA CSF upholds governance, risk management, and vendor controls validation to ensure operational efficiency.

The SAMA Cybersecurity Framework (CSF) makes it mandatory for financial institutions in Saudi Arabia to maintain governance, risk management, cybersecurity operations, and third-party security controls.

The SAMA CSF comprises four major domains:

- Cybersecurity Leadership and Governance: Sets the highest degree of accountability by developing cybersecurity strategy and defining clear roles and responsibilities.

- Cybersecurity Operations and Technology: Implements technical controls to secure information assets and supporting an organization’s infrastructure.

- Cybersecurity Risk Management and Compliance: Defines, approves, and implements a risk management process to safeguard sensitive data.

- Third-Party Cybersecurity: This is strictly for third-party vendors to ensure maintaining cybersecurity protection to the same extent as organizations relying on them do.

Cybersecurity practices among third-party providers (IT. Cloud Service, and Outsourcing) prevent them from becoming a weak link in the security chain.

Understanding NCA Essential Cybersecurity Controls (ECC)

The National Cybersecurity Authority (NCA) of Saudi Arabia represents the Kingdom’s central security entity. The NCA came into effect in 2017 and is primarily responsible for protecting the national interest and critical infrastructure across the Kingdom.

Saudi’s NCA comprises two major cybersecurity frameworks, those being :

- Essential Cybersecurity Controls (ECC): Comprises 5 domains, 29 sub-domains, and 114 controls. These are for strengthening cybersecurity for every industry in the Kingdom.

- Critical Systems Cybersecurity Controls (CSCC): Sets out minimum security requirements for national organizations managing critical infrastructure.

The NCA’s Essential Cybersecurity Controls (ECC-1:2018) provide a broader national-level cybersecurity model covering governance, defence, and resilience for both public and private sectors.

The ECC-1:2018 framework acts as a foundation to establish the essential cybersecurity controls. These controls are derived from applicable global and National standards, i.e., ISO 27001, NIST (National Institute of Standards and Technology).

Through a structured approach, the ECC-1:2018 framework also safeguards the Kingdom’s information and technology assets.

Third-Party Cybersecurity, particularly cloud computing, also comes within the NCA ECC domain. This involves risk management for third-party service provision and securing cloud-hosted resources to ensure data protection, application, and infrastructure against threats.

The scope of NCA ECC extends beyond securing the financial enterprises and applies to every individual business entity that handles sensitive data and critical national infrastructures.

Why Saudi Businesses Should integrate GRC across SAMA & NCA rather than treat them separately

The unified GRC strategy effectively streamlines compliance requirements across NCA and SAMA. This drastically helps reduce compliance silos.

Go through the below-mentioned facts that point out the need for integrating GRC in the Saudi Arabian context:

- Inconsistencies and lack of clarity due to managing two separate compliance requirements, resulting in conflicting controls.

- Increased costs due to resource utilization in excess when complying with two or more regulatory requirements at the same time.

- Higher risk of non-compliance due to significant compliance gaps and subsequent penalties.

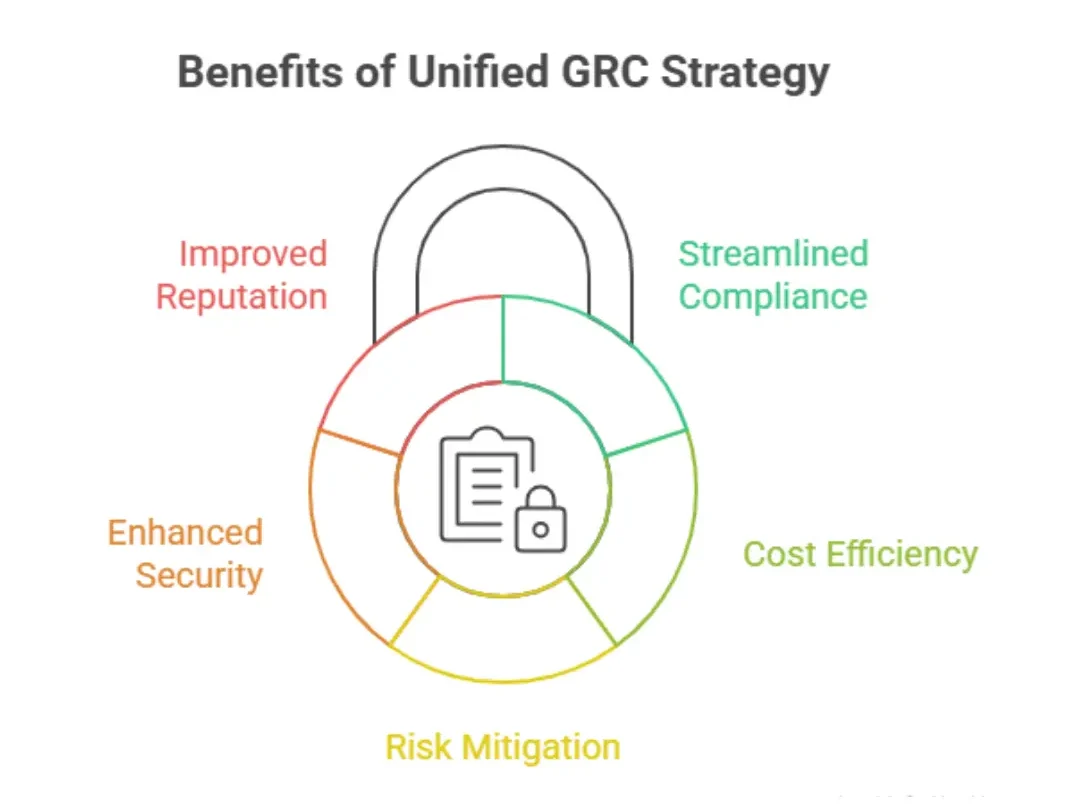

Incorporating GRC across SAMA and NCA helps avoid redundant or duplicate cybersecurity efforts. As a result, you derive:

- Enhanced overall security

- Improved risk management

- Increased business reputation

- Sustained competitive advantage

Also Read : Building a GRC Strategy Aligned with Both SAMA & NCA: A Step‑by‑Step Guide

Overall, GRC integration into SAMA and NCA offers a unified Governance, Risk, and Compliance strategy by bringing their specific requirements into a single and cohesive framework.

Businesses gain a holistic experience in this compliance journey.

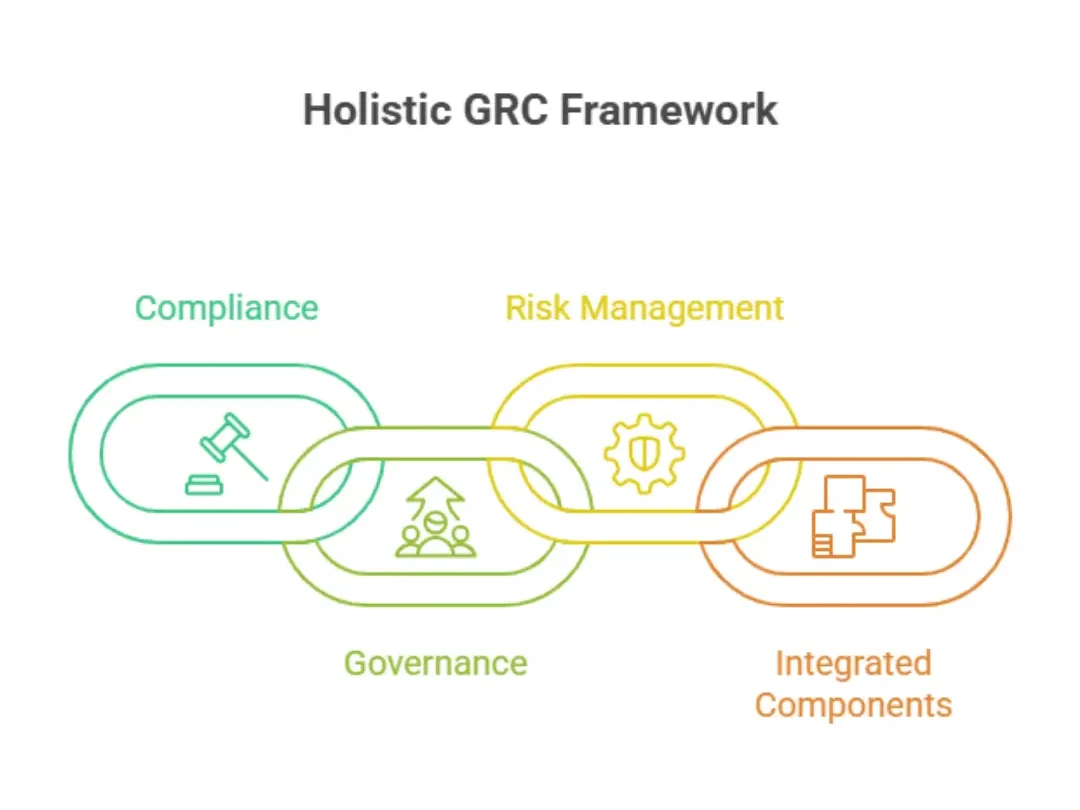

Key components of a holistic GRC framework for Saudi enterprises

Wonder what will help you achieve the holistic GRC framework for compliance efforts across NCA and SAMA? Go through the essential components that this framework holds within it.

Compliance

- Requires you to maintain regulatory adherence, implement necessary policies and controls.

- This should specifically consider Saudi-specific laws and regulations while also paying attention to the international compliance rules.

- Regular or continuous monitoring and reporting of your compliance activities is also mandatory. This will help you identify and address potential gaps then and there.

Governance

- Defining clear roles, responsibilities, and organizational structure is critical to maintain governance oversight and accountability.

- Equally important is ensuring governance structure stays aligned with the overall business strategy.

- Next comes the leadership commitment to driving the GRC initiative for your organization.

Risk Management

- Develop the necessary strategies for mitigating risks by effectively responding to potential issues or vulnerabilities.

- Adopt a risk-based approach to prioritize and remediate risks according to their likelihood of occurrence and potential impact.

Integrated Components and Supporting Elements

- Risk identification and assessment

- Compliance tracking and reporting

- Fostering a GRC integration culture within your team by offering continuous training and awareness programs

- Ensuring continuous improvement of your security measures through real-time monitoring of your compliance parameters.

- Including supporting components like data integration, internal audit management, user authentication, access control, etc.

Role of technical controls and validation (including penetration testing) in GRC, Saudi Arabia

The technical controls and validation, especially including penetration testing, are well regarded as a cornerstone of the Governance, Risk, and Compliance landscape in Saudi Arabia. They serve as primary mechanisms to meet the mandatory cybersecurity regulations in the Kingdom.

For Saudi-based enterprises, maintaining strict compliance with regulatory standards like NCA ECC and SAMA CSF is an obligation to ensure data protection for their clients.

However, this critically demands implementing robust cybersecurity controls to stay ahead of rising and sophisticated cyberattacks.

Validating these controls with high-profile penetration testing is what gives meaning and value to the whole effort.

How Technical Controls and Validations (Penetration Testing) Help Organizations Integrate GRC, Saudi Arabia

| Technical Controls | Validation (Explicitly through Penetration Testing) |

| Policy Enforcement: Help convert GRC policies and procedural guidelines of an organization into actionable and automated security measures. | Validating Control Effectiveness: Existing controls (preventive and detective) are determined of their effectiveness through real-world attack simulation. |

| Risk Mitigation: Reduce the higher likelihoods-cum-impact of cyber threats through breach detection and unauthorized access prevention to enable prompt recovery. | Vulnerabilities Identification and Prioritization: Penetration testing helps reveal potential security gaps and misconfigurations, thus prioritizing remediation efforts based on risk severity and impact. |

| Confidentiality, Integrity, and Availability: Effectively safeguard sensitive data and critical systems as per the NCA and SAMA mandates. | Risk Management Enhancement: Insights from penetration testing provide a more accurate picture of underlying risks. Risk quantification informs decision-making. |

| Compliance with Regulatory Frameworks: Help Saudi-based financial organizations comply with essential controls mandated by regulatory bodies like SAMA and NCA. | Continuous Improvement and Auditor Evidence: Continuous evaluation and improvement with penetration testing are embedded into the GRC process per Saudi regulatory mandates; Detailed reports generated post-penetration testing, offer objective evidence to the regulatory bodies. |

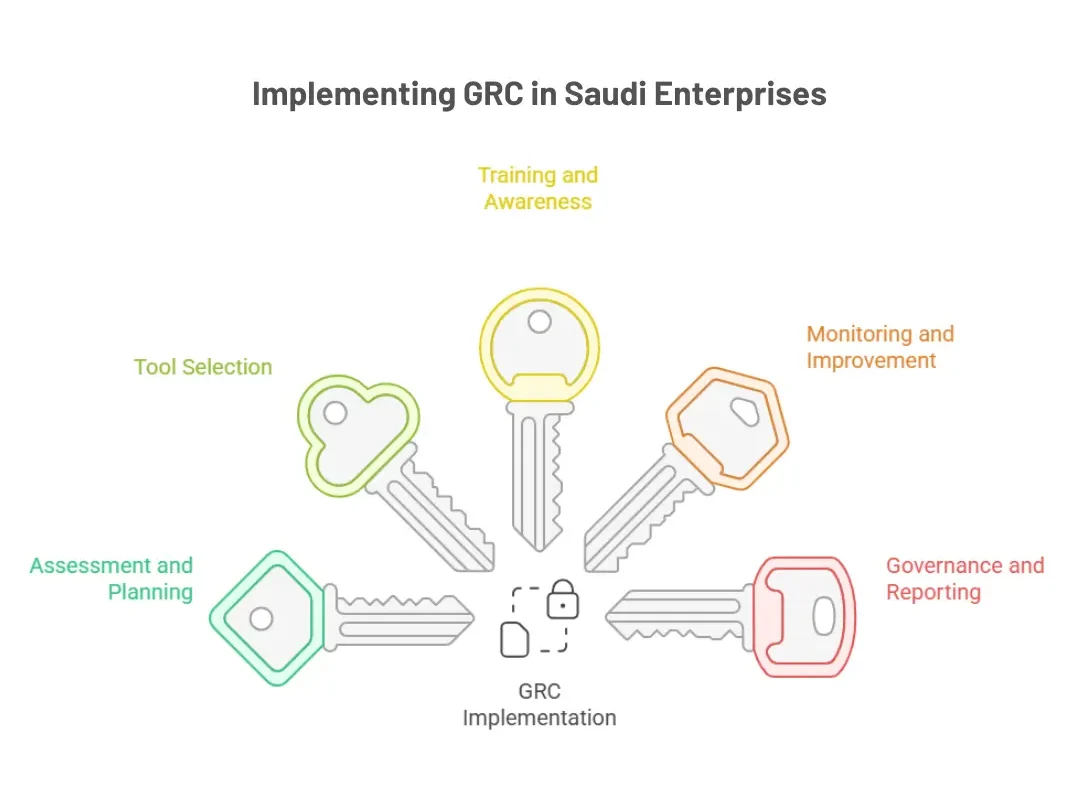

Implementing GRC Into NCA and SAMA Compliance Process for Saudi Enterprises

A successful GRC implementation or incorporation across the NCA and SAMA compliance process necessitates you to follow a phased approach, which includes:

Thorough Assessment and Planning

Meticulous assessment and planning are essential to implementing GRC for complying across NCA and SAMA. Such an approach helps identify areas requiring urgent attention.

This stage requires:

- Evaluating existing GRC processes against the recognized GRC frameworks that include gap analysis and targeted corrective actions, not to exclude automation. Measures like these are directed to find and fix compliance gaps and related inefficiencies that human errors specifically bring about.

- Identify opportunities for automation for those time-consuming, repetitive tasks that are deemed critical in the risk management and compliance process.

- Develop a roadmap for GRC implementation that outlines essential steps, resources, and a specific timeline.

- Connect with relevant stakeholders for a successful GRC integration. This should consider early engagement, set clear communication, and demonstrate value..

Also Read : NCA Compliance and Cybersecurity Excellence: How Saudi Banks Can Achieve Regulatory Success

Implementation and Selection of GRC Tools

- Developing an implementation plan that prioritizes high impact areas and selecting the right GRC tools in a phased approach.

- Selecting a GRC solution for meeting specific criteria like scalability, integration capabilities, compliance, and reporting per NCA and SAMA standards.

- Ensuring that the selected GRC solution or tool aptly integrates with your existing systems.

GRC tools implementation in the Saudi market emphasizes Arabic language support for the most part. This should also consider aligning with local regulations in the likes of SAMA/NCA as a key differentiator.

Training and Awareness

- Educating your employees on the importance of implementing the GRC strategy in spotting cyber threats and understanding their role in maintaining compliance.

- Undertaking periodic training to encourage them to stay compliant with the GRC and demonstrating commitment to the regulators.

Continuous Monitoring and Improvement

- Conduct risk-based security audits and penetration testing for proactively identifying and addressing security weaknesses.

- Based on review from employees, regulators, and threat updates, undertake a continuous monitoring of the GRC strategy to stay ahead of new and emerging threats.

Governance and Reporting

- Develop and maintain a strong governance framework to ensure strong cybersecurity policies are in place through continuous monitoring and clear reporting,

- Define leadership roles and employee accountability as mandated by NCA’s ECC and SAMA’s Governance Principles.

How a Saudi-Based Financial Institution Successfully Met NCA and SAMA Compliance By Effectively Implementing GRC

Organization: A Mid-to-Large Saudi Finance Enterprise

Scope of GRC Mapping: To secure IT, OT, data protection, for third-party vendors, and business continuity

Summary: This mid-to-large financial institution based in Saudi Arabia wished to implement an enterprise-wide GRC to achieve and maintain compliance with both NCA ECC and SAMA.CSF. For this, the company needed to undertake policy integration, control automation, risk assessment, vendor assurance, and continuous monitoring into a single program.

The Process: The unified governance that the company sought through GRC integration was mainly intended to speed up their remediation efforts upon threat (security vulnerabilities) identification.

Tools and Technologies Utilized:

- SIEM (Security Information Event Management) for automated evidence feeds

- IAM (Identity Access Management) for access control evidence

- Vulnerability Management and Asset CMDB (Configuration Management Database) for meeting robust cybersecurity requirements of NCA and SAMA.

- Enterprise GRC Platform for workflow, control mapping, and reporting.

The Result: Endeavours like this ultimately transformed this financial service entity into a single measurable, repeatable, and auditable compliance posture from that of a fragmented one. They could also achieve enhanced cyber maturity through significant reduction in audit findings, faster closure of compliance gaps, etc.

Also Read : Demystifying the Latest SAMA Cyber Security Framework for Financial Institutions in 2025

Lessons Learned:

- Initial assessment and regulatory mapping for both NCA and SAMA for finding out the minimum viable set of controls.

- Prioritizing integrations that offer higher visibility and value, say vulnerability scanners, IAM (Identity Access Management) logs, etc.

- Continuous monitoring and treatment of third-party risks

- Setting timelines for progress and reporting to the Board.

How can Saudi BFSI & SaaS Providers Benefit From Integrating GRC Across NCA and SAMA?

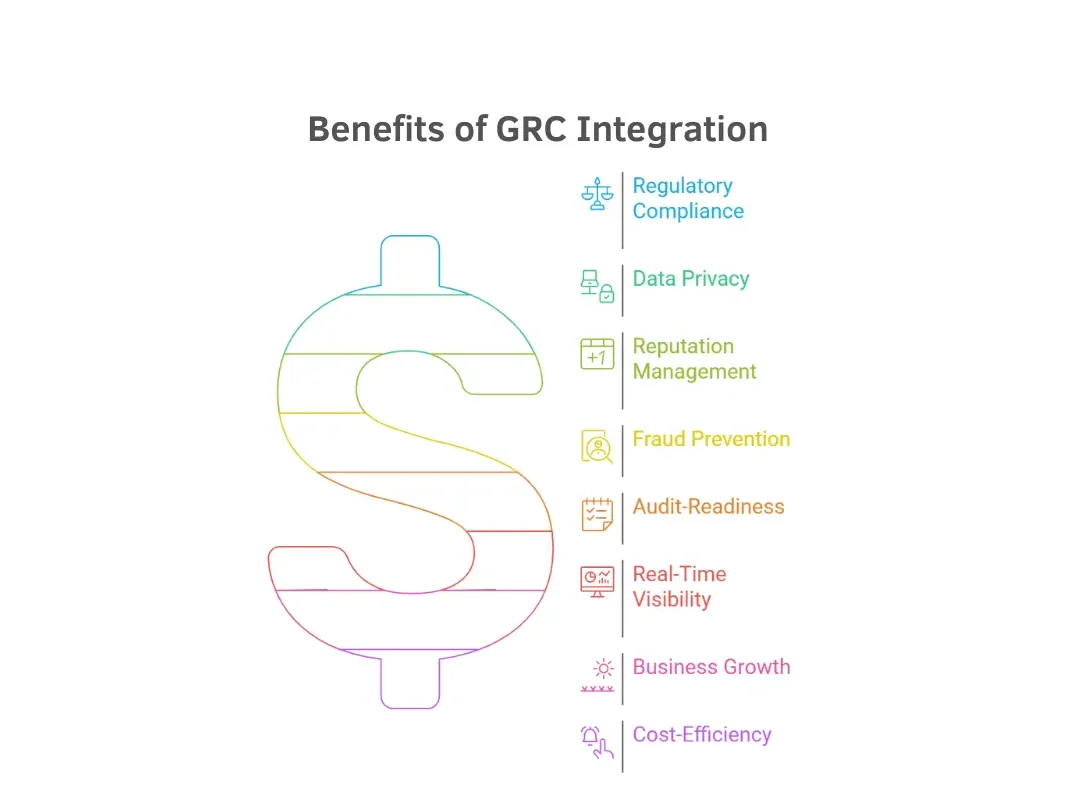

Both BFSI and SaaS providers can benefit from integrating the GRC framework specific to their operational security needs.

GRC Integration Benefits For BFSI Service Providers

- Regulatory Compliance: GRC integration in the financial sector helps operators in the concerned industry to adhere to complex and evolving financial regulations like SAMA, GDPR, etc. more effectively and seamlessly. This helps avoid legal penalties and reputational damage.

- Data Privacy with Transaction Security: With GRC integration, financial firms can secure sensitive customer data in large numbers. It also helps eliminate privacy risks to a significant extent during digital transactions.

- Reputation and Trust Management: By strongly staying committed to the ethical conducts outlined by GRC, Saudi Arabian financial entities can demonstrate both transparency and commitment. This further helps build and maintain trust with customers (clients) and other relevant stakeholders (partners, investors, etc.).

- Prevention of Fraudulent Activities: Helps avoid fraudulent (both internal and external) transactions considerably through prompt detection and elimination of governance gaps through access controls and continuous monitoring.

GRC Integration Benefits for SaaS Operators

- Continuous Monitoring with Audit-Readiness: Continuous security control monitoring with GRC integration platforms facilitate audit-readiness, transforming compliance into a proactive and automated process SaaS tech stack like Jira, Okta, AWS, and Azure can connect directly with GRC integration.

- Real-Time Visibility: Centralized GRC dashboards offer real-time visibility of your compliance posture as a SaaS provider. These help with automated reporting, continuous monitoring, and data-driven decision-making.

- Business Growth Through Stakeholder Trust: SaaS operations with GRC integration offers improved scalability. The latter also helps enhance stakeholder and customer trust through continued commitment to strong governance.

- Cost-efficiency: This is achieved by adopting a subscription-based SaaS model with manual task automation.

A unified governance strategy through GRC integration is getting increasingly recognized as a reliable approach to meet and maintain compliance across NCA and SAMA in Saudi Arabia.

However, it’s crucial to understand the essentials of deriving a practical edge to effectively implement GRC. These being the prime requisites, enable you to level up your compliance posture on holistic grounds, once met.

An expert-led approach is critical to help enterprises in Saudi Arabia successfully meet and ensure compliance across NCA ECC and SAMA CSF.

Here’s where Wattlecorp’s expertise in combining unified GRC strategy with their advanced penetration testing services comes into view.

Well knowledgeable of the existing and evolving regulatory landscape in Saudi Arabia, our services are exclusively designed to enable organizations to strengthen their overall compliance.

Our efforts in these regards highly involve inputting the necessary controls, aligning them effectively with NCA ECC and SAMA CSF compliance requirements. This is not limited to validating their effectiveness to strengthen overall compliance posture.

Having served a handful of clients to ease their compliance process across multiple jurisdictions across the boundaries, these have only enhanced our expertise in helping Saudi-based business entities stay adherent and protected with the applicable cybersecurity laws .

Feeling stuck in your compliance process with NCA ECC and SAMA CSF and don’t know how to make the right move? Leave this problem to us.

Visit our SAMA Compliance Consulting Services in Saudi Arabia service page to gain an idea of how we help clients like you become and stay adherent to these laws,

We also suggest you check our NCA Compliance Services in Saudi Arabia page for this reason as well.

It would also be worth it to visit our penetration testing service in Saudi Arabia to learn how it will help you achieve and maintain a unified GRC governance.

Do not allow compliance to become a burden for you. Connect with Wattlecorp and let our people do the needful.

Partner with Wattlecorp and make your business future-ready with GRC-integrated NCA ECC and SAMA CSF-led compliance and security.

Streamline your compliance journey with GRC Integration today!

Grc Saudi Arabia FAQs

1. What is the relationship between GRC and the Saudi Arabian Monetary Authority (SAMA) Cyber Security Framework?

GRC (Governance, Risk, and Compliance) functions as an organizational strategy for helping financial entities in Saudi Arabia comply with the SAMA CSF. The GRC approach offers a structured system through which the Saudi-based financial service providers can manage, monitor, and report on how they implemented those controls to ensure ongoing adherence to this cybersecurity framework.

2. How do the National Cybersecurity Authority (NCA) Essential Cybersecurity Controls apply to Saudi enterprises?

Every government organization and also those operating within the private sector in Saudi Arabia are expected to abide by the NCA ECC when owning or operating, or hosting the critical national infrastructures in the Kingdom.

3. Why should organisations in Saudi Arabia adopt an integrated GRC approach rather than separate compliance silos?

Adopting the integrated GRC approach offers a reliable and unified governance that helps streamline compliance efforts across regulatory entities (frameworks) like NCA ECC and SAMA CSF. This in turn helps eliminate duplicate or redundant activities. The output should be improved operational efficiency coupled with more informed decision-making and effective-cum-strenghthened risk-management capabilities driven by Saudi Arabia’s Vision 2030 goals, Efforts like these are meant to effectively address the evolving and complex regulatory landscape in the Kingdom.

4. How can a penetration testing service in Saudi help demonstrate compliance for SAMA & NCA frameworks?

A key requirement for both the NCA and SAMA frameworks is to identify security vulnerabilities, Through the attack simulation facilitated by penetration testing, this proactively helps detect potential security flaws before they are found and exploited for malicious purposes.

When firms conduct penetration testing more regularly as mandated by these regulatory frameworks, they can derive and maintain improved security posture for their business, En route to this continued commitment to improve (enhance).their security practices, they become audit-ready on a more confident note.

5. What are the key steps for Saudi financial institutions to build a GRC framework aligned with SAMA & NCA?

Saudi-based financial enterprises should follow a step-wise procedure to develop a GRC framework that meets NCA and SAMA regulatory standards.

• Establish a strong governance structure

• Conduct a gap analysis against regulatory requirements for the concerned frameworks.

• Developing a compliance plan

• Implementing required controls and measures to strengthen cybersecurity posture

• Improve third-party risk management

• Conduct ongoing training to build and maintain a strong cybersecurity culture