Table of Contents

Toggle- Wattlecorp – The Pioneer In Cybersecurity Service Provision

- FinCorp Leader – A Long Story Cut Short

- How FinCorp Leader Met Wattlecorp?

- Wattlecorp X The Financial Client

- Prerequisites To The App Development And Execution Process

- Managing And Securing Payment App With Appropriate Risk Assessment-cum-Management Approaches

- Results

- Wattlecorp’s Experience

- Industry-Specific VAPT Solutions FAQs

Wattlecorp – The Pioneer In Cybersecurity Service Provision

From a visionary startup to becoming one of the world’s prominent cybersecurity service providers has not been an ordinary achievement for Wattlecorp Cybersecurity Labs.

Businesses – whether it be to secure their critical assets or helping them stay compliant with regulatory standards owe their success to Wattlecorp. By offering top-notch industry-specific VAPT services, this cybersecurity service provider has once again proven its supremacy in the regions it serves.

This blog case study describes how Wattlecorp successfully helped a financial enterprise develop and secure a payment app for its customers/clients through its VAPT services.

Serving this client was one of the most remarkable milestones for Wattlecorp by providing VAPT security services.

FinCorp Leader – A Long Story Cut Short

FinCorp Leader was started back in 2000 to offer hassle-free and secured financial service to its customers, investors, and other relevant stakeholders. However, with technology evolving with every passing year, they were worried about just one thing, securing their customers’ valuable data.

The rising cyber threats and events of malware attacks on some of its competitors was enough for it to seek the help of a dedicated cybersecurity service provider.

Also, with people relentlessly victimised by scammers in this digitalised age prompted this financial institution to safeguard their apps, systems, network, and other services.

How FinCorp Leader Met Wattlecorp?

Mobile apps for convenient transactions do save time and money for visiting a bank from time to time. However, built on sophisticated technologies and devices like smartphones, these apps are not immune to the dangers of cyber threats.

Our financial client knew the hurdles associated with payment apps, as well as the security risks involved when undertaking transactions.

When it concerned offering online banking facilities to their customers/clients/partners, developing and deploying a highly secure payment app was more than a necessity.

Equipped with a full-fledged technical team to build and handle a secure payment app, they were, however, apprehensive about the security loopholes existing within.

Running and deploying the app while being doubtful of its security was a concern that demanded extra attention and a solution-driven approach.

Scammers and malicious intruders posing as officials demand a whopping sum from their victims. They send threatening messages via sms or emails, such as virtual arrests to psychologically victimise the latter.

With such incidents demanding stringent security measures and to prevent the same, the concerned institution considered it best to build a mobile payment app built with strong security parameters.

In all these pursuits, the enterprise simultaneously wished that no malicious hackers, ransomware, or malware got near to the security framework of its applications (both web and mobile).

The commitment to protect its customers’ data by unbreakably securing its business from the inside out loomed larger. In fact, more than the potential threats and attacks reigning in the cyber world.

Our client ultimately started their search for a security service provider that will strongly secure its app development process through to deployment.

All the more, it wished to become proactive enough to prevent any impending threats or attacks from the malicious hackers.

This financial entity, therefore, expected the following from its security service provider:

Knowledge, Experience, and Expertise: The proposed project demanded significant knowledge and expertise with a knack to utilise the essential tools involved.

Full-fledged Tech and Security Team: A team that exclusively comprised skilled tech personnel, a proficient cybersecurity analyst, and network security testers to develop a secure mobile payment app.

Reliability: Expected a staff that was highly accountable and dedicated enough to provide a fool-proof result that also aligned with its business objectives.

Also Read : What is VAPT ?

Wattlecorp X The Financial Client

Even though Wattlecorp met the search criteria for a fulfilling security service provider, they still had to undergo a test. It was critical as far as it meant to prove their proficiency when securing the service for this particular client.

Understanding the enterprise’ priority to enhance its service and operations, we set out on this challenging, yet exciting endeavour.

Our VAPT professionals knew that efficiency, expertise, and technical aptitude highly mattered when serving this financial client of ours. Having completed a small security test successfully, they became convinced of our overall ability to tackle any similar task given the level of complexity.

Prerequisites To The App Development And Execution Process

Our first task in the project was to acquire an in-depth understanding of the organisation’s requirements when developing an efficient, smart, secure, and reliable payment app.

Our VAPT experts felt it appropriate to integrate the necessary security tools to detect potential flaws in the applications coding during development and deployment. This helped them ensure code quality for our client, enabling the latter to identify and fix security issues through the VAPT assessment.

The next step was checking the essential parameters to safely run the mobile payment app.

- Ascertaining Security: Specifically concerned with protecting sensitive customer data, including purchases and transactions made.

- Enforcing Trust and Transparency: A payment app built on trust and transparency was the prime requirement.

- Third-party Risk Management: Undertaking VAPT assessment was also paramount to assessing and managing third-party risks.

Managing And Securing Payment App With Appropriate Risk Assessment-cum-Management Approaches

In line with our client’s expectations, we thought it best to manage and secure the Mobile Payment app development process by utilising the following approaches:

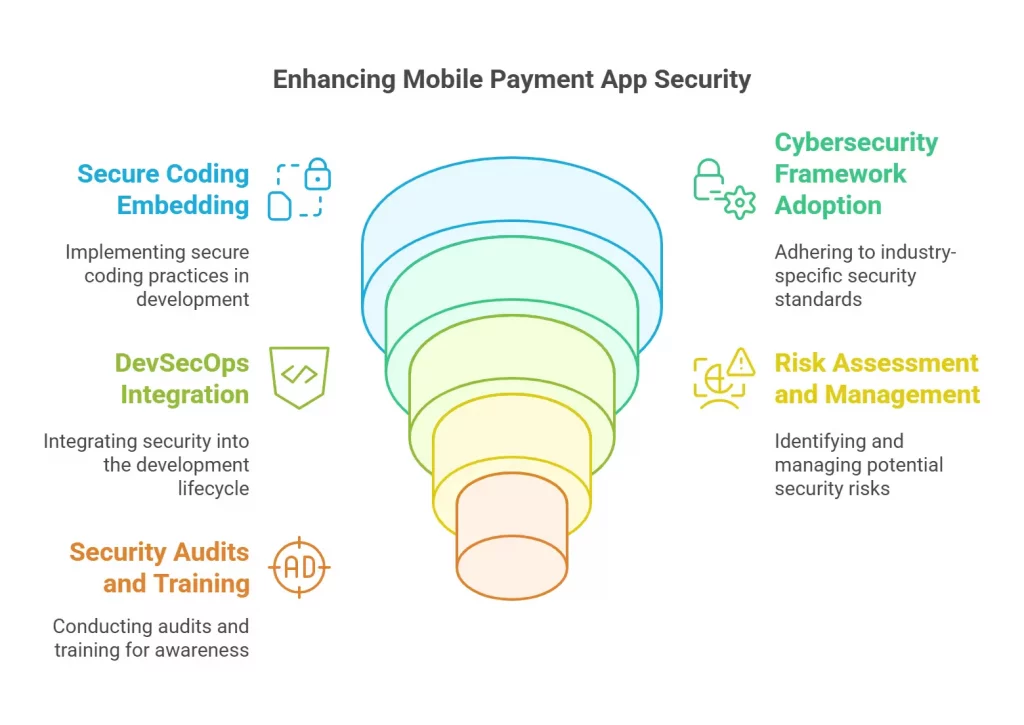

- Embedding Secure Coding

Enforced secure coding in every phase of the mobile payment app development. It also involved encrypting the source code of the desired application.

Also performed penetration tests to identify, fix, and mitigate vulnerabilities to deliver a safe payment ecosystem.

- Adopted Cybersecurity Frameworks

Also Read : 6 Proven Strategies to Build a High-Performing Cybersecurity Team

Adhering to industry-specific cybersecurity frameworks, such as PCI DSS and ISO 27001, were crucial to improving and maintaining compliance requirements. These were enough to help us establish baseline security standards when developing the application, in turn, optimising business security for our client.

Our VAPt professionals also went beyond their assignments to guide our client’s developers by providing them with clear guidelines. These were mostly centered on ensuring code quality – both in their static and running state.

- Ensured Security In Development Lifecycle by Incorporating DevSecOps

DevSecOps is a cybersecurity framework that mandates integrating security into the Software Development Life Cycle (SDLC). This concept involves developing, securing, and operating a software application to minimise risk factors.

Applying DevSecOps to developing the mobile app helped with early detection of issues, reducing time on rework.

We also leveraged tools to automate static and dynamic code analyses. This helped streamline our security assessment processes for this client without overlooking vital areas. Smart moves like these helped us achieve enhanced code quality.

- Risk Assessment and Risk Management

Risk assessment and risk management are critical components in cybersecurity service provision.

Risk assessment and risk management are critical from a financial institution’s perspective for the dozens of sensitive data they handle. Acknowledging this fact helped our client effectively manage and address potential third-party risks for successful project completion.

This process required continuous monitoring by detecting and addressing any real-time security lapses.

Regular Security Audits And Penetration Testing combined with Cybersecurity Awareness Training For Clients and Third-Party Vendors

Every industry and organisation requires security audits. Conducting regular audits enhances and strengthens their security posture.

Here’s how security audits helped the concerned financial institution:

- Carrying out a dedicated penetration testing helped identify and mitigate vulnerabilities.

- Insisted on undertaking cybersecurity awareness programs for the employees and vendors to ensure security and strict vigilance.

- Helped protect sensitive data by notifying team members and vendors of their respective roles on these lines.

Results

- Effective Risk Mitigation upon identification.

- Enhanced trust and confidence among the stakeholders, including customers.

- DevSecOp-embedded development and execution of the payment app

- Improved adherence to Data Regulation and Protection Standards.

Wattlecorp’s Experience

As an established cybersecurity service provider, we believe that our victory lies in serving our clients in the best possible manner. We give equal importance to developing long-lasting relationships with every company that approaches us for their varied security needs.

The satisfaction and joy we derive while making our clients secure and happy, providing them what they want is an achievement in all respects. This understanding has helped us achieve a huge clientele across the globe.

Trust and confidence are the pillars of credibility in business. The more trust your customers have for you, the more you rank in terms of credibility. Wattlecorp has achieved just that!

Also Read : AWS Penetration Testing: Checklists, Tools, Strategies, and Best Practices

Worth adding here is the fact that by providing scalable cybersecurity solutions considering all the key aspects involved, we could prove our expertise in this regard.

VAPT assessment is critical for every business, large or small, and regardless of the industry in which they operate.

Your chances of losing the trust and confidence of your clients are way higher if you don’t possess an expert tech and cybersecurity team for your organisation. It’s also important to hire the right VAPT service providers, who’ll give you the needed guidance to safeguard your business and sensitive data. Efforts will also include looking into the key aspects of security that will help financial institutions like yours save money, time, and effort.

Remember that VAPT for Fintech or any other industry is all about securing sensitive data by identifying, assessing, and mitigating potential vulnerabilities and threats. For this financial client to count on us serves one such instance, where we could offer VAPT services at our best .

If you also operate in the financial sector and are wondering about whom to rely on to secure your operations and services, consider getting in touch with Wattlecorp. Leave us a message and our team will call you back shortly.

Still here? Visit our website to know about the type of VAPT Assessment Services we offer.

Book a Penetration Test today and stay ahead of emerging cybersecurity threats!

Industry-Specific VAPT Solutions FAQs

1. What do VAPT Assessment Services involve?

VAPT assessment services typically involve scanning for potential security vulnerabilities for an organization’s IT (information technology) and OT (operational technology) system and networks in a comprehensive manner. If vulnerabilities are detected, penetration testing follows to exploit them by simulating cyber attacks to assess the impact of the latter. This is followed by documenting/reporting the findings and making the necessary recommendations to mitigate the risks or threats to improve and strengthen the security posture of the concerned organization.

2. What are the VAPT Security Assessments for FinTech organizations?

VAPT security assessments for Fintech organizations include helping the latter to abide by both national and industry-specific regulatory standards. This can be facilitated by helping identify and fix vulnerabilities in the cybersecurity architecture to prevent financial losses and maintain consumer trust and confidence.

3. What can be included in VAPT Services for FinTech?

Vulnerability assessment for FinTech should cover network scanning, mobile and web application scanning, and assessing cloud environments. You are also expected to conduct social engineering and wireless security test if you want your FinTech organisation to steer clear of malicious hackers.