If you’re a banking entity primarily operating in India, when was the last time you undertook a cybersecurity checkup? Whatever your answer be, this shows how concerned you’re about your security.

It’s true that traditional security testing approaches are not enough to withstand evolving cyber threats. For banks and fintechs, outdated security checks are a strict no-no. This is obviously because of the highly sensitive information they handle, including financial and critical customer data, and many more.

VAPT (vulnerability assessment and penetration testing), has emerged as the one acceptable and effective security testing for banks and fintech organizations in India. It protects your systems and sensitive data by proactively identifying and mitigating possible security flaws before hackers get there and exploit/attack them.

But how often should your financial organization consider undertaking VAPT? While experts recommend annually, is that enough to bolster your security? Whatever it may be, understand that being a financial enterprise owner, you definitely need VAPT on a more regular basis.

Table of Contents

Toggle- What is VAPT and Why Does It Matter For Banks and Fintechs in India?

- How Does VAPT Differ From Regular Security Tools Or Audits In India?

- How Often Should Indian Fintech Companies Conduct VAPT?

- Why Are Banks and Fintechs Prime Targets For Cyberattacks In India?

- Real-World Case Of Not Considering VAPT For Fintechs

- Why Is Annual VAPT Considered Effective For Indian Banks and Fintechs?

- Key Benefits of Undertaking Annual VAPT for Financial Enterprises

- Common Pitfalls For Indian Banks To Avoid When Conducting Annual VAPT

- VAPT for banks and fintechs FAQs

What is VAPT and Why Does It Matter For Banks and Fintechs in India?

VAPT is a security-testing method that combines both vulnerability assessment and penetration testing to proactively test your defenses against potential cyber threats.

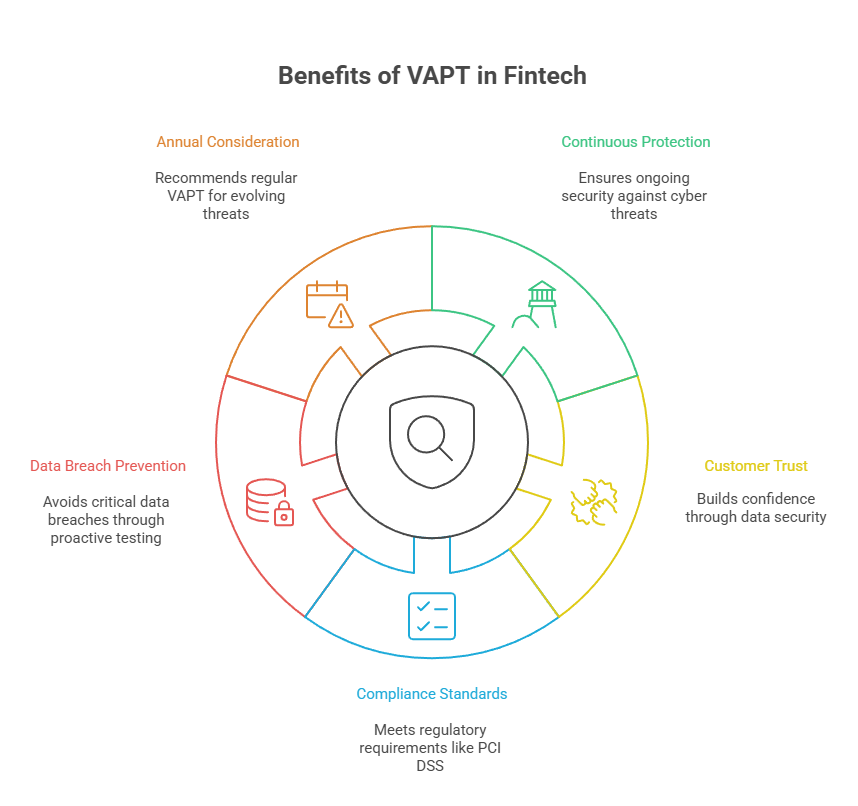

VAPT for Fintechs In India highly mandates delivering a reliable security testing service. It guarantees continuous protection for your systems from potential hackers through proactive identification and mitigation of hidden vulnerabilities. It also goes a step further to safeguard your customers’ critical information, thus earning their trust and confidence.

Additionally, when it comes to meeting compliance standards like PCI DSS in the country, VAPT is again the one go-to solution.

Several organizations around the world have adopted and benefitted from regularly integrating VAPT into their daily operations.

Cybersecurity in fintech exclusively involves avoiding critical data breaches by undertaking real-world attacks to identify and resolve existing vulnerabilities within your systems, applications, and network.

This is in wake of the RBI (Reserve Bank of India) issuing the RBI Cybersecurity Framework issuing specific guidelines for financial institutions to boost their security posture.

Staying ahead of cyberattacks in a digital world rife with threat landscape matters. And with banks not immune to the same, this critically suggests the need to consider VAPT at least annually.

How Does VAPT Differ From Regular Security Tools Or Audits In India?

Fintech cybersecurity with VAPT for Indian fintech companies offers a comprehensive, yet ongoing assessment to keep up with the challenges imposed by the rapid technological advancements. This cannot be offered by any regular or standalone security-cum-standard audit tools.

Reassuringly, a combination of vulnerability assessment and penetration testing offers you a security edge that no hacker can dare to break.

Also Read : 5 Signs Your Business Needs VAPT Immediately

In short, vulnerability assessment accompanied by penetration testing gives you the focus and advantage by providing the needed methods. What you derive is an enhanced security posture through a realistic security assessment.

How Often Should Indian Fintech Companies Conduct VAPT?

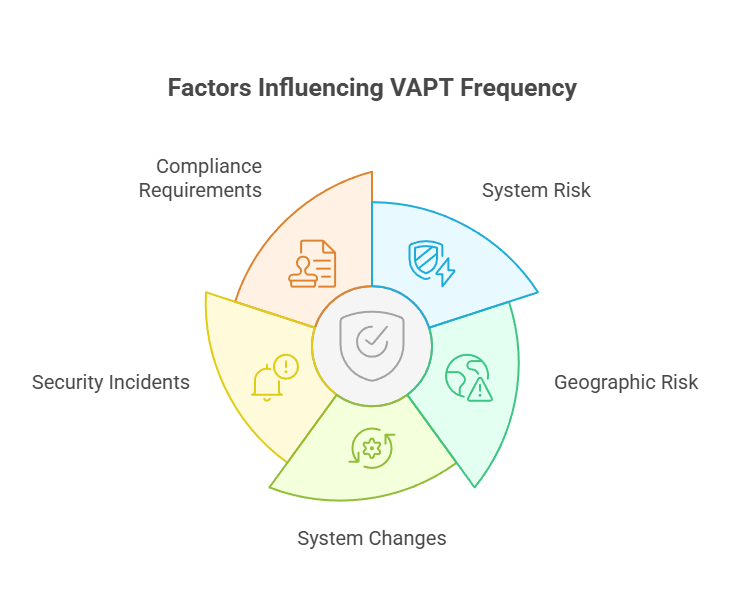

Fintech cybersecurity with VAPT is as critical as it is for any other businesses operating in the critical industry domain. However, the frequency of undertaking VAPT for banks depends on how risky the systems are when handling sensitive information.

Per expert recommendation, banks and fintech enterprises should undergo VAPT at least annually. Again it depends on how critical your systems are, the amount of sensitive information it handles, and the country it is operating. If it is in a highly risk-prone region, this means you should conduct VAPT more regularly – quarterly or continuously.

Also, if you’re planning to make any major systemic changes for your bank, are facing frequent security incidents, or need to meet compliance requirements, you should consider VAPT more often.

The aforementioned criteria is what makes VAPT a regular health check for your organization – specifically if you are operating in the banking industry. How regularly you need a VAPT assessment depends on how weak or strong your systems are!

So, how strong are your security systems? Schedule a Pentest today!

Why Are Banks and Fintechs Prime Targets For Cyberattacks In India?

Based on existing information, it is the financial enterprises that are becoming prime targets for attackers. This is because of:

- High-value data and transactions: Chances for fraudulent exploitations are high for banks that handle highly sensitive information. Note that the fraudsters can knock you down anytime to extract money through phishing and other malevolent activities.

- Regulatory obligations and customer trust: The need to stay compliant with regulatory standards, maintaining customer trust – are another of those potential factors, making banks a frequent target for black-hat hackers.

Real-World Case Of Not Considering VAPT For Fintechs

Ever since we’ve started relying on digitalization, what we’ve been relentlessly experiencing is frequent security incidents on an off-and-on basis. With each of them carrying their specific magnitude of exploits and resultant impact, these strongly underpin the need to undertake a more robust security measure.

You might have heard of the 2017 Equifax data breach case. This had about 147 million consumers lose their personal information to data theft due to a web application vulnerability. Hackers allegedly exploited the credit card details and social security numbers (SSN) of its consumers.

Also Read : How Industry-Specific VAPT Solutions Secured Payment App For A Financial Enterprise

The case of Equifax has taught how hidden and unattended vulnerabilities can lead to massive breaches.

The motto is to keep pace with the evolving cyber threats to protect your vital digital assets – always!

Why Is Annual VAPT Considered Effective For Indian Banks and Fintechs?

As we’ve seen earlier, it’s not only annual VAPT that’s quintessential to a safe banking safety. What counts more is how often conducting pentests secures your bank from known (and unknown) threats.

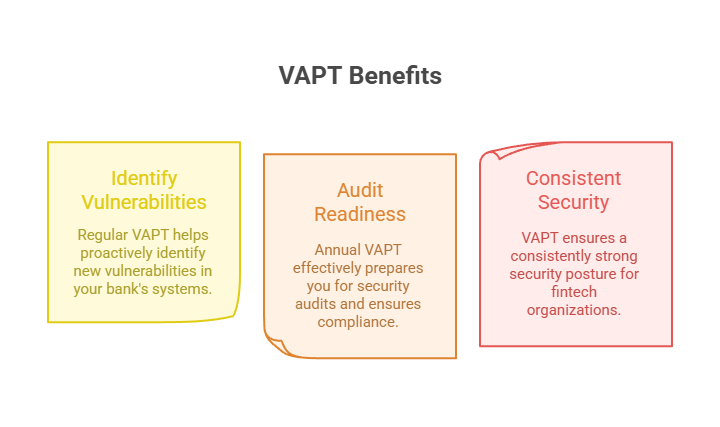

- Proactively Identify New Vulnerabilities: Regular/annual VAPT for your banks help you identify vulnerabilities in a more proactive manner.

- Readiness To Audits and Compliance: You can effectively prepare for security audits and meet compliance requirements with annual VAPT.

- Offers Consistency: The most relevant feature that fintech organizations can avail when conducting VAPT is ensuring a consistently strong security posture. Provided you combine it with a more regular VAPT assessment.

With annual VAPT, you can negate potential breach incidents. However, if you conduct it more regularly, say every 3 months, you stay a step ahead of exploits and malicious attacks.

Key Benefits of Undertaking Annual VAPT for Financial Enterprises

Along with delivering the above features, annual VAPT also helps you with:

- Early threat detection

- Strengthened compliance posture

- Improved customer trust

- Reduced downtime risk

Think of the value you derive when your customers shower uninterrupted trust on your services and offers. Will not this make you uniquely incredible as a banking/financial institute?

Common Pitfalls That Banks Should Avoid When Conducting Annual VAPT

Though annual VAPT provides you considerable benefits, you can only avail them if you avoid certain pitfalls.

Below you can find the most common mistakes that you can avoid when conducting VAPT on an annual basis.

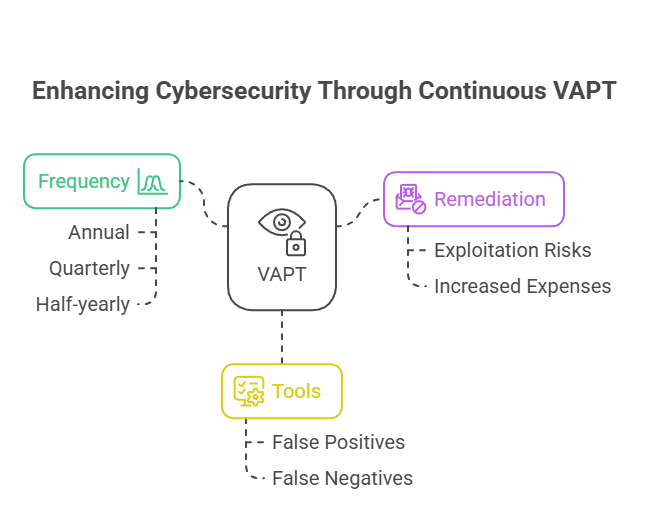

• Thinking of VAPT as a one-time activity

Even though annual VAPT is highly recommended for banks, you shouldn’t assume it to be a one-time activity. It’s a continuous process intended to help you protect your systems and make your defenses strong enough to be resilient to emerging threats and untoward consequences.

Apart from conducting VAPT on an annual basis, undertaking them quarterly or half-yearly will help you stay ahead of cyber risks.

• Side-casting Remediation Efforts Post-VAPT

It doesn’t matter how effectively your team or vendor has carried out a VAPT assessment and test for you. What truly does is implementing them the way those experts recommend.

Failing to do so exposes identified vulnerabilities to further exploitations of a greater extent – hard to manage, time consuming, and increased expenses.

• Over-dependence On Automated Tools

Relying heavily on automated tools instead of manual penetration testing carries a high likelihood for false-positive/false-negative outputs. Note that false-negative findings can be trickier than their false-positive counterparts.

The more regular you are in conducting VAPT, the more resilient you become to evolving cyber threats. You reach a point where you can confidently prepare for security audits.

Common Pitfalls For Indian Banks To Avoid When Conducting Annual VAPT

While annual, quarterly, and semi-annual VAPT are considered worthwhile for the finance industry, these do not suffice to render it totally secure. This highly applies when your bank is operating in India. The thing is in conducting VAPT more often – depending on how critical your systems are.

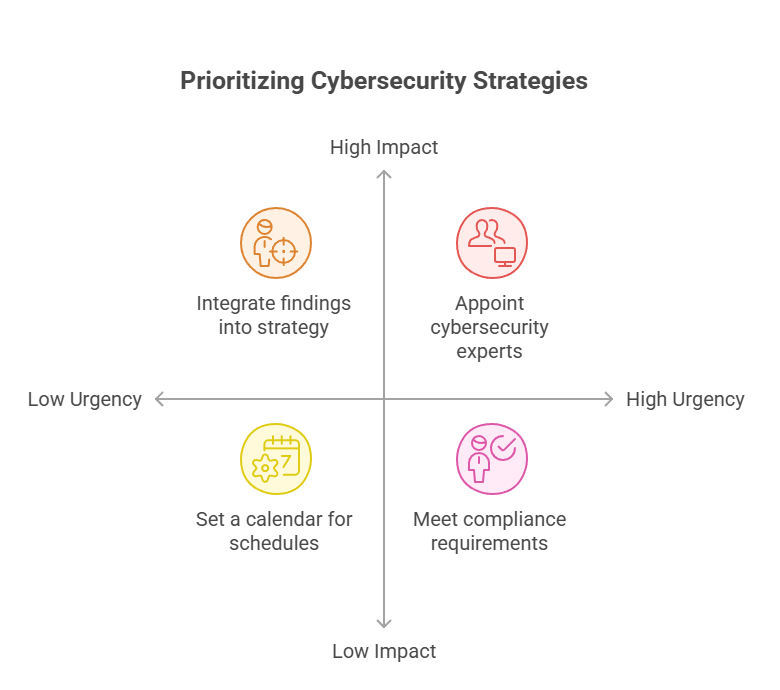

Here are a few things for banks like you to consider when undertaking a full-fledged vulnerability assessment and penetration testing.

- Consider meeting industrial-cum-national compliance

- Appoint/partner with the right cybersecurity experts

- Set a calendar for undertaking quarterly, half-yearly, and yearly schedules

- Integrate findings into long-term security strategy

If you religiously follow these practices in undertaking VAPT for your banks/fintech enterprises, you’ve already set yourself in the trajectory of optimal cybersecurity. A practice, which is more routine than mere reaction to actual cyber incidents.

VAPT for finance is not a choice, but a necessity – especially when it comes to safeguarding critical systems and data from breaches and ransomware.

In the face of evolving cyber threats, VAPT has become a life-time investment for businesses handling critical assets – both theirs and those of their customers.

So, are you one of those banking and fintech entities willing to conduct VAPT to secure your systems and sensitive data?

You think you’re secure enough to face overwhelming cyber threats for a year? Connect with Wattlecorp to know where your defenses stand. Schedule a VAPT assessment today!

If safeguarding your health is important to you, so does your data!

VAPT for banks and fintechs FAQs

1.Why should banks and fintechs in India conduct annual VAPT security testing?

For banks and fintechs, annual VAPT goes a step ahead than mere security testing to safeguarding and strengthening their defenses against potential cyber threats and ensuing attacks. The fact that Indian banks are constantly targeted by hackers makes them highly vulnerable to cyberattacks.

By offering a structured-cum-proactive approach to security testing, VAPT prompts early detection, analysis, and resolution of hidden security flaws in your critical systems and data.

2.Is annual VAPT sufficient to strengthen the security posture of banks/fintech enterprises?

No, it isn’t for most cases. Though annual VAPT enhances security posture for your bank, you require a more regular assessment of your systems when handling highly sensitive information. Things like credit card details of your customers/clients, financial information, personal data, etc., need to be critically safeguarded. Hence, besides conducting annual VAPT, you should also consider undergoing quarterly and semi-annual penetration testing to identify and mitigate risky vulnerabilities.

3.What are the points that should be considered when undertaking annual VAPT for finances?

•Define the scope.

•Focus on both known and unknown vulnerabilities.

•Understanding potential attack vectors.

•Analyzing your systems for possible vulnerabilities.

•Conducting third-party vendor assessments.

•Undertake thorough reporting, documentation, and remediation.