Table of Contents

ToggleSAMA CSF Compliance: Detailed Explanation Guide to Help Fintechs

Imagine the situation where a new customer checks if your systems are secure. You would certainly try to figure out what you can do to grab the customer’s trust. SAMA CSF in the Saudi Arabia framework addresses the security concerns of fintech businesses and organizations in KSA. SAMA could sound like one of many government regulations framed to burden your IT teams. But, it isn’t.

Launched by the Saudi Arabia Monetary Authority or SAMA, which is the central bank of the country, the framework deals with combating cyberattacks aimed at the financial sector. This ultimate cybersecurity process framework helps your organization be equipped with risk management, governance, and management of tech/vendors. Want to learn more? Let’s get into detail about SAMA compliance and the comprehensive guide towards practicing it for your fintech business.

What is SAMA Compliance in Saudi Arabia?

The Definition & Scope

Specifically speaking, SAMA controls are meant to safeguard the resilience of Saudi Arabia-based financial firms. In 2017, the financial industry in Saudi Arabia witnessed a tremendous change. Financial organizations, banks, fintech companies, and other related businesses have increasingly met with complex security risks. To address these growing threats, SAMA introduced a comprehensive Cyber Security Framework in 2017 to act against these scams, attacks, and network breaches with a unified set of cybersecurity controls.

The key mission of SAMA CSF is to ensure the cyber resilience of every financial organization in the KSA. That’s why the SAMA framed a 5-pillar mega checklist with 29 objectives and 114 sub-controls. The subcontrols are mapped into 6 maturity levels intended for progression rather than perfection. SAMA is drawn from multiple global cybersecurity frameworks, for example, ISO 27001. Here are the areas the framework covers:

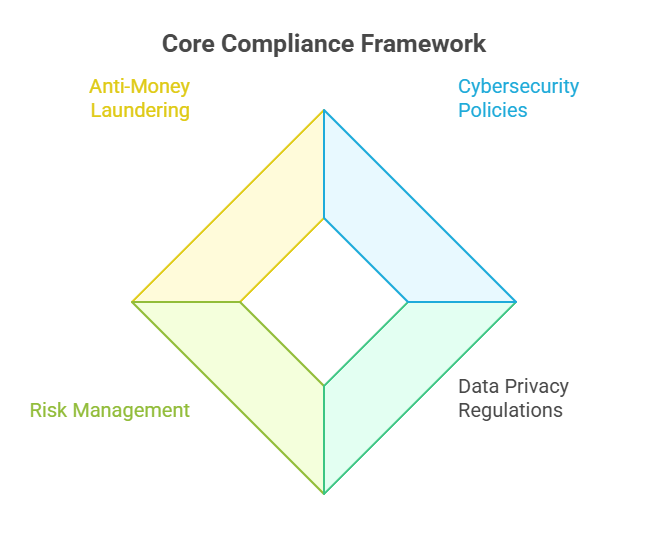

- Cybersecurity policies to protect customer-related data and financial data.

- Data privacy regulations to ensure that customer data is legally and ethically managed.

- Risk identification and management policies.

- Anti-Money Laundering (AML) standards that identify and prevent financial fraud.

SAMA CSF Compliance in KSA- Whom Does it Impact?

If you are puzzled whether SAMA CSF compliance applies to your business, it is a big yes if you are engaged in a financial business in Saudi Arabia. The businesses that should follow SAMA CSF compliance:

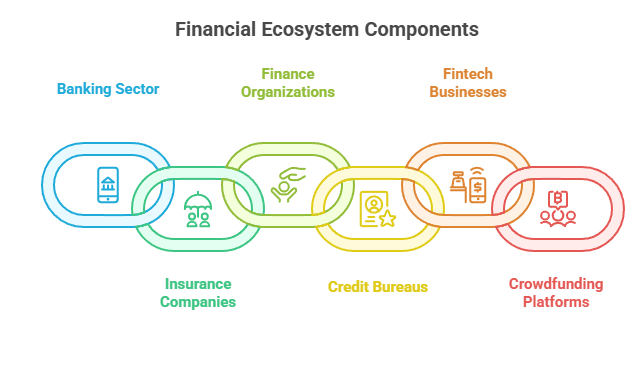

- Licensed companies that fall under: health, travel, auto, or liability insurance.

- Finance organizations involved in micro lending, leasing, or consumer finance.

- Credit bureaus handle credit scores and credit histories.

- Fintech businesses, e-commerce payment gateways, and mobile wallet providers.

- Crowdfunding platforms and peer-to-peer lending platforms.

The SAMA cybersecurity framework also expands to the finance service providers and third-party vendors. If you are a tech company and provide software to a financial firm in Saudi Arabia, you should be SAMA-compliant.

If you ignore SAMA cybersecurity mandates, you will be charged penalties, have your license revoked, suffer reputation damage, etc.

How to Implement SAMA CSF in Fintechs?

Here’s a breakdown of SAMA CSF implementation steps that can also act as the SAMA cybersecurity framework checklist you should take care of and implement as a fintech company in Saudi Arabia:

Step 1: Learn about SAMA CSF regulations

Review the SAMA regulatory needs that align with your business. The SAMA regulations for cybersecurity encompass everything, including financial disclosure of user protection. Be careful about:

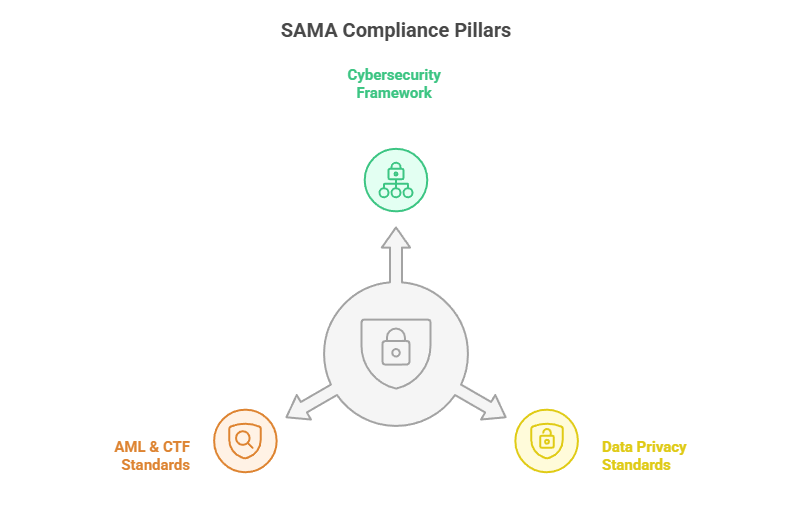

•SAMA cybersecurity framework: it includes the cybersecurity demands like incident management, network security, and data encryption.

•Data privacy standards: These include the guidelines to secure customer data against misuse.

•AML & Counter-Terrorist Financing (AMF) standards: They include demanding that fintechs track, report, and prevent money laundering activities.

Step 2: Implement a comprehensive compliance assessment

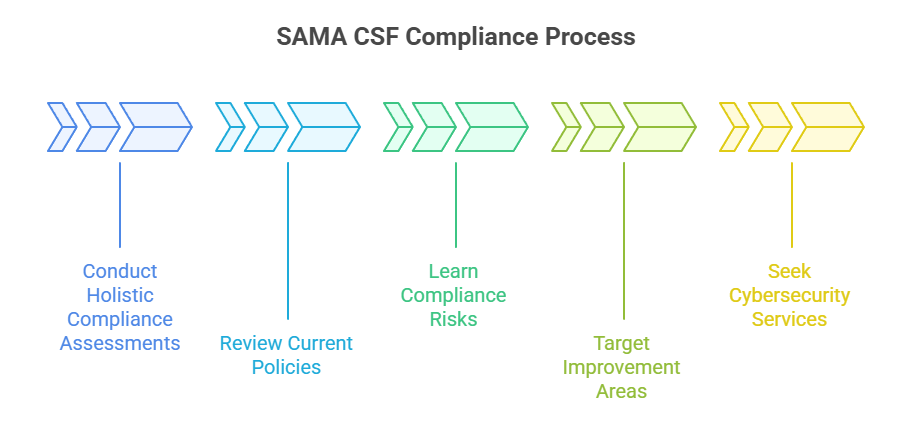

Conduct holistic compliance assessments to analyze the gap between the existing operations and SAMA needs. It should consist of:

- Reviewing the current policies, procedures, and practices.

- Learning the compliance risks.

- Targeting areas where your business should improve to meet the SAMA compliance regulations.

- Seek the help of a cybersecurity services provider for SAMA CSF compliance solutions.

Step 3: Choose the best compliance approach

After knowing the compliance concerns, choose a strategy to fix them. You can adopt:

- Risk mitigation to implement controls to find and resolve any complexities.

- Adopt a data protection policy to secure customer-oriented information.

- Cybersecurity strategy with incident response plans, vulnerability checks, and data encryption.

Create a timeline and allocate resources for all your compliance processes. Focus on high-risk areas and involve core departments.

Step 4: Implement Compliance Controls

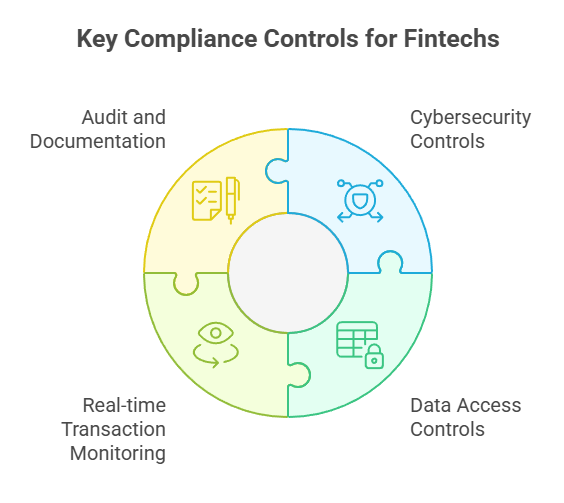

Fintech businesses should deploy certain operational controls to meet SAMA CSF compliance demands. These are:

Cybersecurity controls: Protect your systems against cyberthreats with network security, consistent tracking, and endpoint security.

Data aess controls: Lay stringent data access protocols to inhibit unauthorized access.

Real-time transaction monitoring: Implement real-time monitoring to detect any suspicious activities and avoid money laundering.

Audit and documentation: Keep appropriate records for every compliance process and execute frequent audits.

Step 5: Provide Team Training

This is one of the key SAMA CSF framework implementation steps to follow. Implement SAMA CSF compliance for fintech training to let employees:

- Understand the need for data privacy.

- Adopt the best practices for cybersecurity.

- Adhere to the anti-money laundering policies.

Step 6: Monitor & Update Compliance Practices

As risks can grow, you should take care of scaling your compliance measures. Develop a system to track the compliance updates from SAMA and frequently review the compliance measures to keep your business compliant for a long time.

Also Read : SAMA Compliance as a Competitive Advantage: Enhancing Trust and Security in the Financial Sector

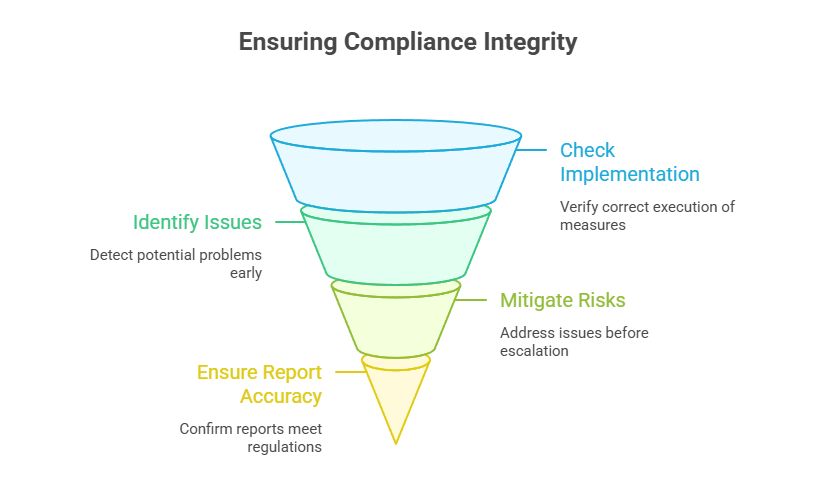

Step 7: Conduct Internal Audits

SAMA CSF audit for fintechs plays a significant role in compliance management. Regular audits help you:

- Check if the compliance measures are implemented correctly.

- Find possible issues before they turn complex.

- Ensure that the reports strictly follow the compliance regulations.

Step 8: Report Compliance to SAMA

The periodic reporting is necessary for fintechs to ensure compliance. This involves compilation of the necessary reports, following documentation’s accuracy, and sticking to specific deadlines.

By reporting the compliance status to SAMA, you can demonstrate your commitment to the regulatory authority, thereby improving business operations and reputation.

Also Read : Sama Cyber Security Framework: A Detailed Guide

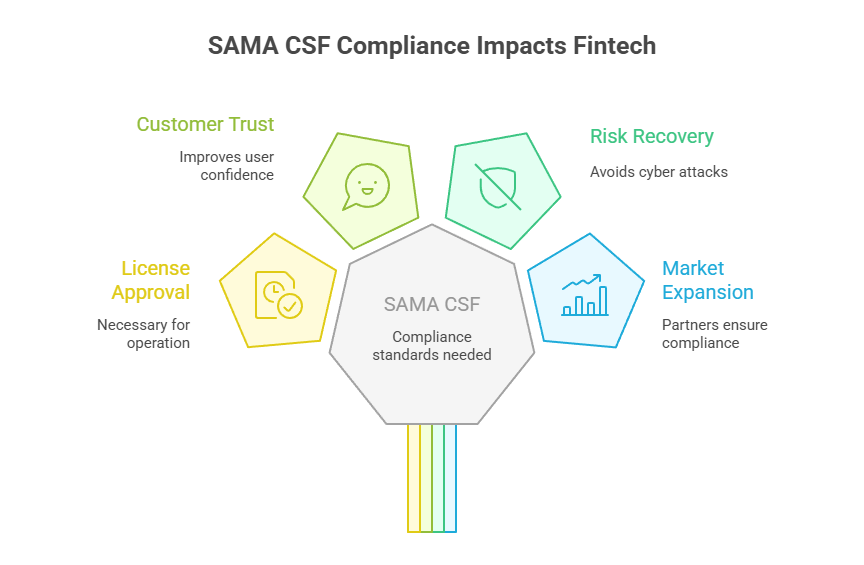

Significant Advantages of SAMA CSF Compliance Standards

Achieving SAMA cybersecurity compliance for fintechs might sound overwhelming.

But with the ideal compliance strategy, you can achieve many advantages:

- Operational legalities: SAMA CSF compliance standards are necessary for a license.

- Customer trust: Compliance improves trust, as the users are more likely to choose a service with assured compliance and security.

- Recovery from risks: SAMA CSF compliance framework is a way for businesses to avoid the chances of cyber attacks, operational concerns, and financial outbursts.

- Market expansion: Partners and investors should ensure SAMA compliance while they engage with fintech businesses based in Saudi Arabia, which helps to expand their presence.

Achieving SAMA regulations for cybersecurity needn’t be a lengthy task. You can align with the stringent needs of SAMA cybersecurity compliance with automation of control mapping, evidence monitoring, and management.

If you’re looking to upgrade your compliance strategy and achieve SAMA compliance for your business, Wattlecorp can help you keep your business compliant and highly secure.

With the top cybersecurity services and SAMA CSF compliance solutions for your fintech business, our team can support you to keep your operations highly compliant. To learn more about how we help, talk to our team.

SAMA CSF FAQs

1. What is SAMA CSF compliance?

The CSF SAMA compliance framework was implemented by the Saudi Arabian Monetary Authority with focus on ensuring cybersecurity of the fintech businesses based in KSA.

2. What are SAMA CSF core requirements?

SAMA CSF framework should follow governance, risk management, cyber-resilience, third-party security, incident response, and compliance tracking.

3. How does SAMA CSF apply to fintech companies?

SAMA compliance mandates that fintechs ensure cybersecurity controls are embedded into their technology, data management, and all third-party processes.

4. What is the penalty if my business is non-compliant with SAMA CSF?

Non-compliant businesses to the SAMA CSF Saudi Arabia has following penalties:

• Compensation/fines

• Operational limitations

• License cancellation

5. How to prepare for SAMA CSF audits?

Keep detailed reports, perform internal audits, ensure implementation of security controls, and train the organization’s teams on the SAMA cybersecurity framework.