Table of Contents

Toggle- What is the SAMA Cybersecurity Framework?

- Why is the SAMA Framework Relevant for Saudi Arabian Businesses?

- Who Should Consider the SAMA cybersecurity framework in Saudi Arabia?

- How to Apply the SAMA Cybersecurity Framework in business in Saudi Arabia?

- What Benefits Do Institutions Gain from Compliance?

- How VAPT Practices Help Achieve SAMA CSF in Saudi Arabia?

- SAMA Cybersecurity Framework FAQs

What is the SAMA Cybersecurity Framework?

The SAMA Cybersecurity Framework (CSF) is a set of regulations, policies, and guidelines issued by the kingdom’s monetary authority. This rule was declared to regulate and strengthen the cybersecurity capability of all financial institutions based in Saudi Arabia.

The first version of the framework, introduced in 2017, aligns with international regulatory rules. Though it includes the practices followed in various government frameworks, it is prepared specifically to address the threat landscape that financial institutions in the Kingdom face.

The nation’s authority mandates this to make the organizations follow the governance structures, security controls, and risk management processes in a move to protect customers’ data, systems, and assets.

Why is the SAMA Framework Relevant for Saudi Arabian Businesses?

According to Statista’s recent update on the study between 2021 and 2022, it is identified that malware is the common type of cyberattack affecting financial and insurance-based institutions. When considering the global scenario, the financial sector is mainly targeted the most by cyberattacks.

Above all, the threats are becoming more sophisticated, and businesses are facing attacks like ransomware, phishing, and insider threats. The 2024 global data breach report prepared by IBM highlights that the financial industry is one of the top three targeted sectors. The average cost of a breach has also crossed USD 4.88 million.

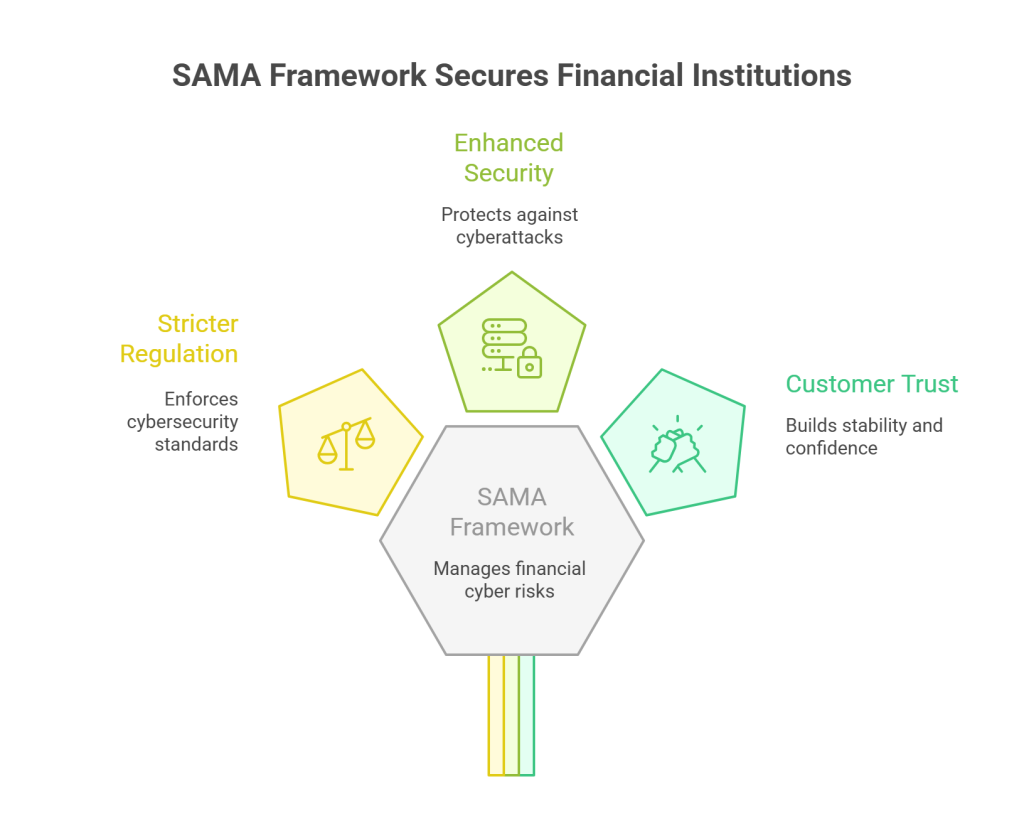

Saudi Arabia is rapidly migrating towards digital enablement and when the digital banking adoption and fintech startups are also growing, the stakes are even higher. The remedy to this is to build stricter regulation. Here, the SAMA cybersecurity framework addresses this situation by using a structured way to manage risks.

So, to build a business secure from emerging cyberattacks businesses must strictly abide by the SAMA regulations for financial institutions to stay defendant in the critical threat landscape. It goes beyond technical security to include governance, regulatory alignment, and operational resilience while the purpose is to build stability and customer trust.

Who Should Consider the SAMA cybersecurity framework in Saudi Arabia?

The framework is not limited to banks alone. It applies to all financial institutions licensed and regulated by SAMA. This includes commercial and digital banks, insurance companies, credit bureaus, financing firms, leasing companies, and even fintech startups that have hold of sensitive customer transactions.

In general, this framework is applicable to any financial organization that operates under Saudi Arabia’s Monetary Authority. These businesses must strictly comply with the framework.

Also Read : Achieving SAMA CSF Compliance: Step-by-Step Implementation for Fintechs

From the government perspective, it is a regulatory obligation to be fulfilled, but for these entities, it is a necessity in keeping their business stable while maintaining customer trust and benefiting by avoiding possible losses.

Whether it is a large multinational bank or a growing fintech company, adopting the SAMA framework helps the business stay compliant and manage business continuity.

How to Apply the SAMA Cybersecurity Framework in business in Saudi Arabia?

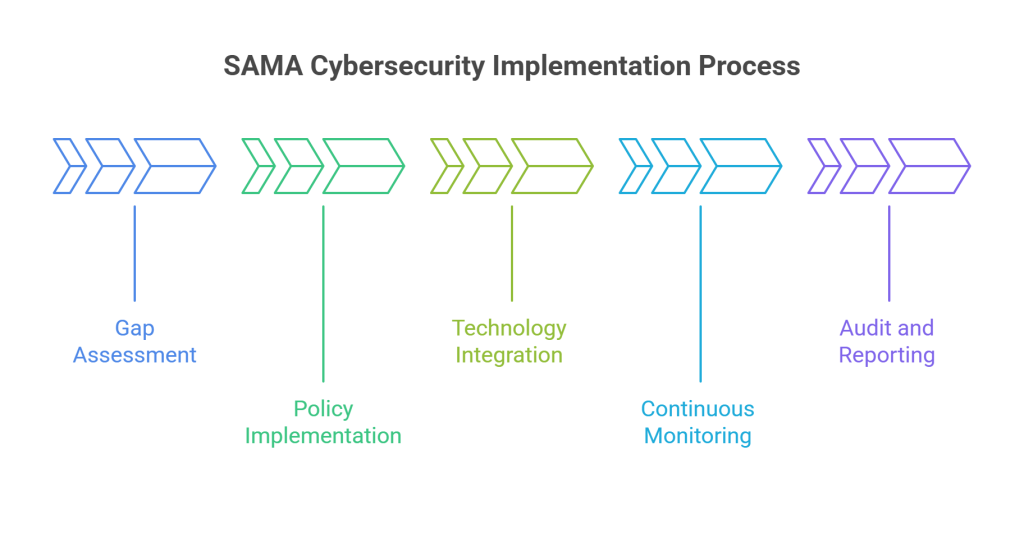

Applying the framework requires a structured and strategic approach.

Gap assessment

The first step involves evaluating the institution’s existing cybersecurity posture and the measures against the SAMA compliance requirements 2025. This assessment highlights areas of improvement, and missing controls

Policy implementation

Once security gaps are identified, organizations must establish formal security policies that cover data privacy, identity and access management, and protocols to protect data.

Technology Integration

Include security measures like advanced security solutions for incident detection and protect cloud workloads. Integrating VAPT practices can be more helpful in identifying the underlying threats or weaker ports.

Continuous Monitoring

Following up with penetration testing and regular assessments can keep the organisation updated with the live scans and detections.

Also Read : SAMA Cybersecurity Framework Checklist

Audit and Reporting

Finally, proper documentation and audit reporting must be practiced. This will help you prepare for regulatory inspections.

This process may seem long and complex, but implementing the SAMA cybersecurity practice in an institution is the best way to project a business’ strong trusted presence with its tested practices.

What Benefits Do Institutions Gain from Compliance?

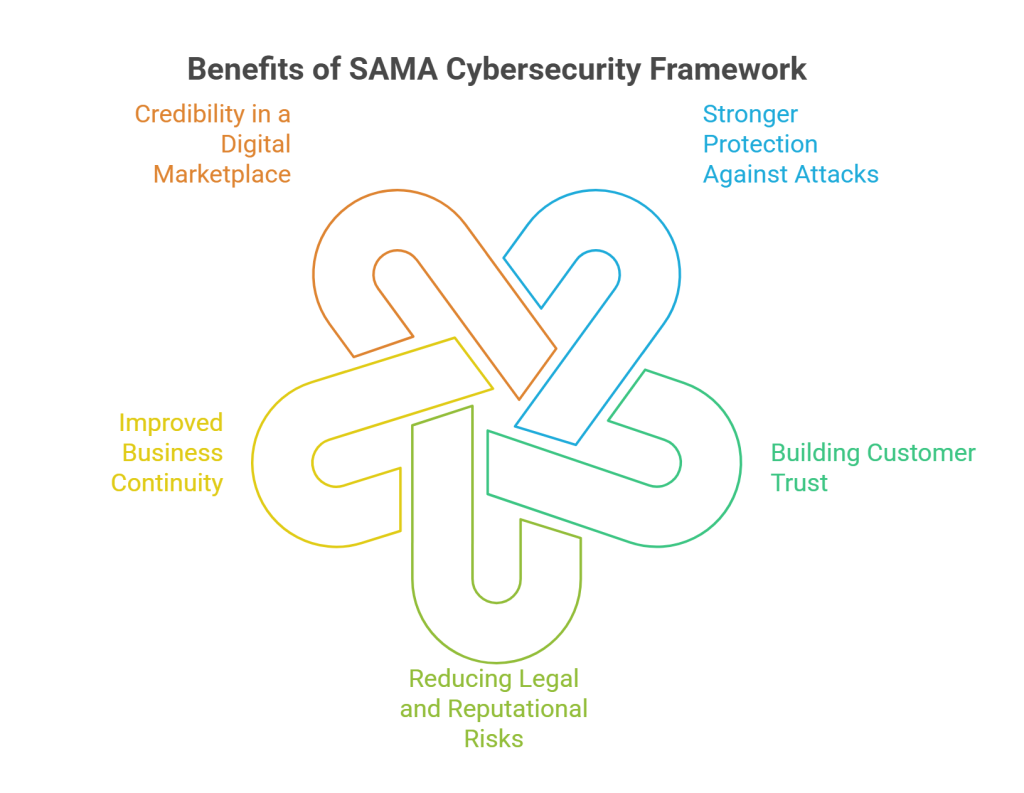

Stronger protection against attacks – Following the SAMA cybersecurity framework makes financial institutions less vulnerable to cyberattacks. Threats like ransomware, phishing, and data breaches can be avoided.

Building customer trust – The consumer trust is what keeps these banks and financial firms alive, as it involves their savings, investments, and private data. A breach in trust can deter a number of valuable customers, and when a business shows that they truly value and protect customer interests, it earns trust eventually.

Reducing legal and reputational risks – Failing to adhere to SAMA’s CSF can lead to heavy penalties and a loss of reputation. The framework helps organizations stay safe from financial risks.

Improved business continuity – A short downtime can even deflect the customer base to seek another provider. A major cyberattack can shut down operations for weeks. But SAMA helps businesses operate with continuity even in the face of incidents.

Credibility in a digital marketplace – There is a huge rise in digital banking and fintech institutions. At this point, compliance gives institutions a competitive edge. It positions them as trustworthy leaders who adopt modern and secure practices.

How VAPT Practices Help Achieve SAMA CSF in Saudi Arabia?

The vision behind this SAMA Cybersecurity Framework (CSF) is to proactively work to identify, manage and mitigate cybersecurity risks in every financial based Saudi Arabia’s entities. One of the most effective ways to achieve this is through Vulnerability Assessment and Penetration Testing (VAPT).

Vulnerability assessment is a better practice in identifying the threat factors using a structured analysis. This allows institutions to prioritize remediation in line with SAMA’s compliance requirements.

This continuous cycle of testing, fixing, and retesting is critical in maintaining compliance. It also keeps the environment prepared and defensive.

Saudi Arabia’s financial ecosystem is moving to an advanced level, with digital banking, fintech growth, and making use of advanced technologies. While opportunities and technology in the kingdom are expanding, so are the risks. Such risks are mitigated when a business complies with the SAMA cybersecurity framework.

Recognizing the need for this regulation, Wattlecorp stands as the best provider of SAMA cybersecurity services so that all finance-based businesses in Saudi Arabia align with the government issued standard. Our experts perform Vulnerability Assessment and Penetration Testing (VAPT) to build these businesses, adhering to SAMA’s evolving framework.

SAMA Cybersecurity Framework FAQs

1.What is the SAMA Cybersecurity Framework?

This framework is created by the KSA’s Monetary Authority, with a set of rules and guidelines. The rule declares that every Saudi Arabian financial institution, like banks, insurance companies, and other financial institutions, follows it. The reason behind designing this framework is to protect customer data, manage risks, and stay safe from cyberattacks.

2.Why is SAMA important for financial institutions in Saudi Arabia?

Cyberattacks are incessantly growing, and especially when it comes to the financial sector, the aftereffects can be costly. Failing to provide secure banking services can attract penalties and even loss of customers when breaches happen. That’s why the SAMA framework is essential to ensure financial institutions have the right security controls in place.

3.How does the SAMA framework ensure cybersecurity compliance for banks?

The framework gives banks structured rules to implement in their operations to build strong cybersecurity practices. Banks must assess their current security, close any gaps that can turn into ports for threats, and continuously monitor their defenses. By taking these steps, banks can effectively apply SAMA CSF in their daily practice and stand effectively against risks.

4.How can VAPT services help in achieving SAMA compliance?

Vulnerability Assessment and Penetration Testing (VAPT) are helpful practices in acquiring SAMA’s standards. The process involves finding hidden weaknesses in the systems by simulating real-world cyberattacks. Through this technique vulnerabilities are identified, aand businesses can fix them before attackers exploit them.