Table of Contents

ToggleWhat is Fintech Penetration Testing?

Penetration testing, otherwise known as pentesting, is a security procedure performed by ethical hackers to identify the weaker spots and vulnerabilities in applications, infrastructure, APIs, and networks before hackers lead through them and exploit the system, resulting in breaches.

In fintech penetration testing, professional testers go ahead of the basic vulnerability assessment. They make a thorough analysis across the business’s various infrastructures and systems, including web/mobile banking apps, wallets, and trading platforms.

When it comes to fintech security, penetration testing comes as an effective option. According to Computer Weekly, they report that, even though the fintech institutions have a strong security posture, they are likely to face increased risks due to insecure third-party links. This states the need for fintech penetration testing in UAE banking businesses.

Security limitations and bottlenecks of Fintech Systems in the UAE

The UAE is said to be among the most targeted countries by malware attacks. According to the Hubbis report, as financial crimes increase and global regulations become stricter, several countries, including the UAE, are strengthening their AML, KYC, and CFT measures.

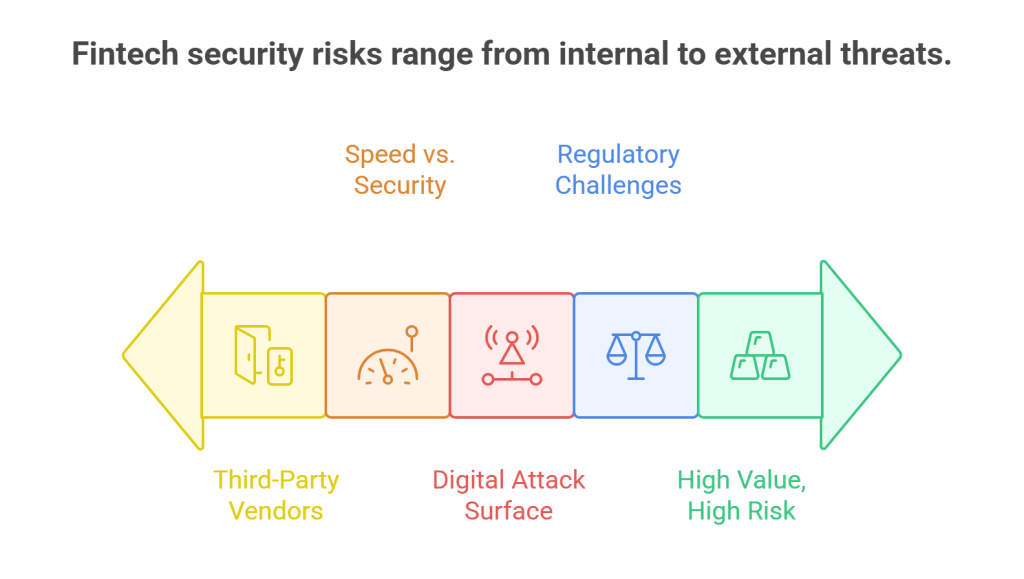

Though the security measures are built defensively, the UAE financial institutions at times face challenges in building a resilient environment. Some security constraints are quite common in fintech businesses, like:

Increasing Third-Party Risks

FinTech platforms mainly rely on many interconnected sources for their active banking businesses. Many third-party vendors, including those used for payments, KYC, and analytics, sometimes lack comprehensive security measures. With their weak security posture, they serve as a port for malicious actors and deter banking security.

As an effective measure, fintech businesses must perform vendor checks and continuous monitoring to reduce such risks.

Struggle Between Speed and Security

Fintech business operations are frequently evolving owing to the industry’s need, and they make constant updates to be competitive. To stay customer-centric, these institutions make quick launches and new feature updates, which sometimes compromise security.

Moreover, users prefer quick logins and instant payments. In such instances, the biometric feature can cause delays resulting in customer drop-off.

Expanding Digital Attack Surface

FinTech apps use mobile, cloud, and API-based systems, where a huge amount of sensitive data is involved. These interconnected apps and systems with various entry points serve as a port for threats.

These threats can turn into costly breaches, and the resolution includes performing continuous monitoring, proactive threat detection, and layered defenses.

Regulatory Challenges

The regulatory rules constantly come with updates, and it’s complex to address them very frequently. Moreover, these fintech institutions must follow fintech compliances, including PCI DSS and GDPR, in addition to the UAE’s security and data protection laws like PDPL.

When these fintech businesses are expanding across different horizons, they must abide by the particular region’s regulatory standards. Failing to comply with these can bring fines and heavy penalties.

Also Read : Internal vs External Penetration Testing: Which is Right for Your Business?

High Value, High Risk

As these fintech institutions process highly valuable financial data, hackers mainly target this sector. They breach through phishing, ransomware, and API attacks to steal user details. In such circumstances, regular testing and encryption are essential to keep data safe.

Steps to follow in FinTech Penetration Testing in the UAE

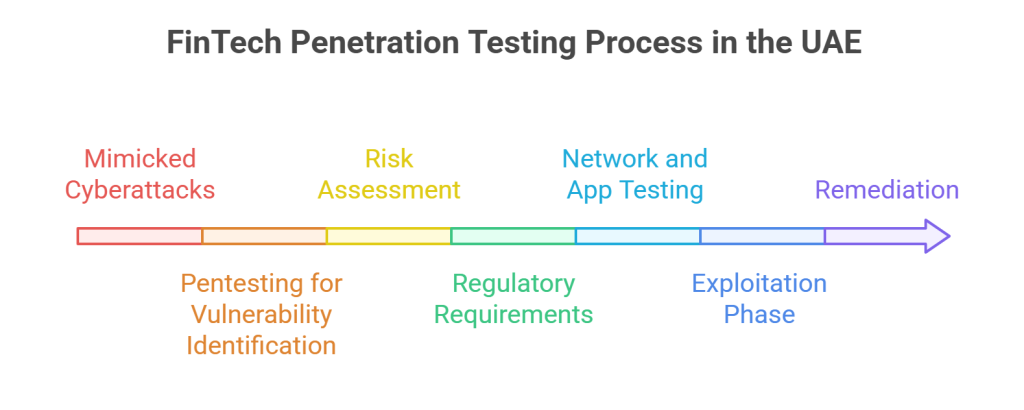

Mimicked Cyberattacks

The initial step is to perform simulated cyberattacks through ethical hacking methods. Such attack scenarios replicate the real-world attack instances, and these help identify how breaches happen including the ways in which intruders cause damage. This is an effective method to spot the potential threats before they happen.

Pentesting for Vulnerability Identification

Mimicked scenarios usually expose the weakness in the system, including apps, networks, and APIs. The expert testers look for bugs, misconfigurations, or gaps that threat factors can breach by following different types of penetration testing methods. By identifying these vulnerable areas, experts can take measures to prevent breaches earlier.

Risk Assessment

After the vulnerabilities are detected, the experts analyze them for the risk possibilities. At this point, the likelihood of exploitation and potential damage that might happen are listed out. Following this, the tester takes essential steps, prioritizing the depth of harm it can inflict.

Regulatory Requirements

FinTech companies in the UAE should follow the regulatory standards of the nations in which they project their services. Also, they must abide by local data protection laws, including the PDPL of the UAE. By performing penetration testing, testers verify if the systems meet these regulations.

Network and App Testing

The company’s entire infrastructure is checked to detect weakness. In this phase, professionals analyze the networks, servers, and applications. Such security testing allows the testers to check if the sensitive data is under threat or is accessible.

Exploitation Phase

With the findings of vulnerable areas, the testers exploit them to recognize the harm they can cause. This is exactly the replicated scenario of how the unethical hacker makes an intrusion. Through this, organizations can understand the severity of each risk.

Remediation

In this final step, the tester fixes the weaker ports and improves security. They take measures like stronger defenses, patches, or configuration changes and strengthen security.

Benefits of Penetration Testing in the UAE Fintech Sector

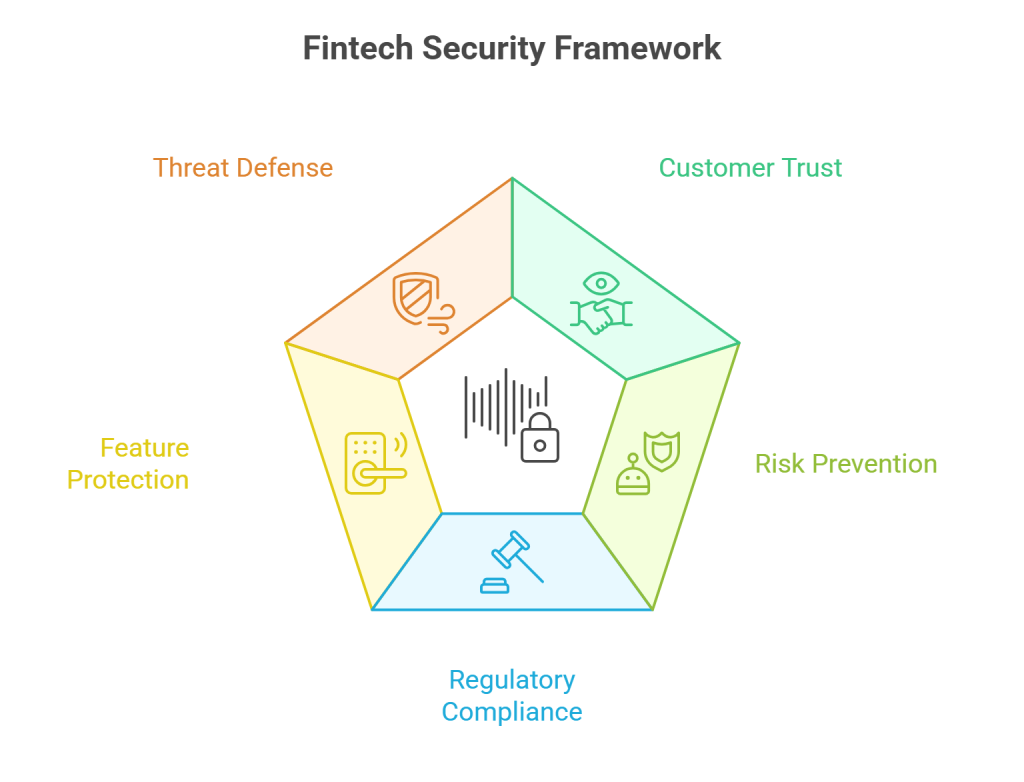

Build Stronger Customer Trust

Fintech businesses majorly depend on a huge customer base. So, maintaining trust is the root to keeping the business active and successful. A secure platform with safe transactions retains customers.

Identify and Prevent Risks Early

Pen testing helps companies find vulnerabilities before hackers can exploit them. Securing weak points involves strengthening the security of exposed APIs. This in turn can prevent huge data leaks. Such early detection reduces the chance of unauthorized access and costly breaches.

Also Read : Why Penetration Testing is Essential for Secure API Development

Stay Compliant with Regulations

To deliver a secure digital banking process, fintech institutions must strictly follow regulations. It includes compliances like PCI DSS, GDPR, and local banking laws. By doing regular penetration testing, fintech companies can easily pass audits, thereby avoiding fines and proving to be compliant-ready.

Protect New Feature Releases

The fintech industry releases new updates frequently, and these become a breeding point for threats. Regular digital banking penetration testing keeps the newly launched services secure by identifying the loopholes and resolving them before they turn harmful.

Defensive to Evolving Threats

Though the security is tightened across the digital banking activities, cyber offenders find new complicated attack methods. So, it’s always essential to be prepared to defend against new threats, and regular pen testing serves as the best resolution.

Banking businesses handle huge amounts of sensitive financial data. Moreover, the UAE is seeing massive growth in the financial sector, making them a prime target for unauthorized attacks. With a significant percentage of people relying on this industry, a single breach can tarnish the reputation and bring down the customer retention. So, it’s very essential to invest in FinTech security services.

Only certified and experienced professionals are skilled enough to handle complex threat instances. Wattlecorp has an expert team with extensive experience in detecting high-risk malicious activities. Through detailed penetration testing, our experts access vulnerabilities across networks and provide practical solutions that strengthen the security of your digital banking activities.

Fintech Security FAQs

1.Why is FinTech Penetration Testing Critical for UAE Banks?

FinTech penetration testing is a simulated cyberattack activity performed with ethical hackers or professional testing professionals. This is performed on banking systems to find vulnerable areas before hackers get through those. To secure the sensitive banking information and to provide unmatched safe customer service, the UAE banks must perform regular penetration testing.

2.What are the typical phases and methodologies in a FinTech Pen test?

First step is defining the scope and gathering information. Following this, experts identify the weakness and scan for weaknesses by exploiting them and report the findings. Through VAPT practices, banking businesses can easily understand risks and plan effective security measures.

3.How to Choose a VAPT Company in the UAE for Digital Banking Security?

Only certified experts with years of experience can handle complex challenges. Professional testers of Wattlecorp usually follow clear methodology, integrating necessary regulatory compliance into the processes and interfaces. You can check the authenticity by referring to our clients and check the credibility.